About Company

Metadata Technologies

Metadata Technologies is a leading business application firm focused exclusively on assisting organizations in planning, designing, implementing and operating business application solutions and strategies that are central to creating and maintaining a competitive advantage.

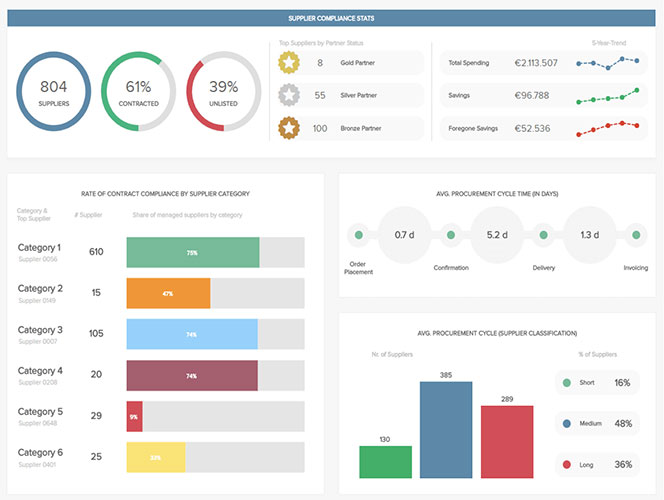

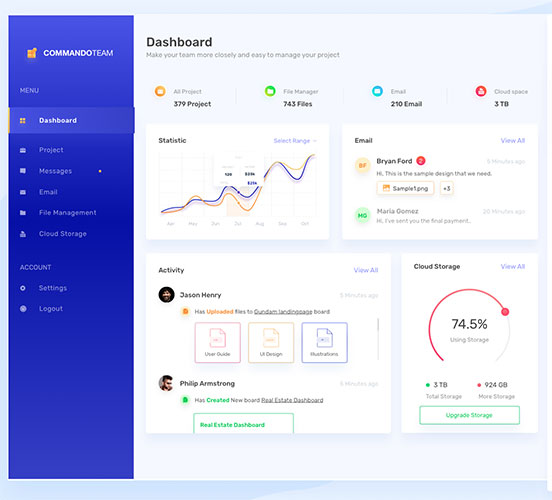

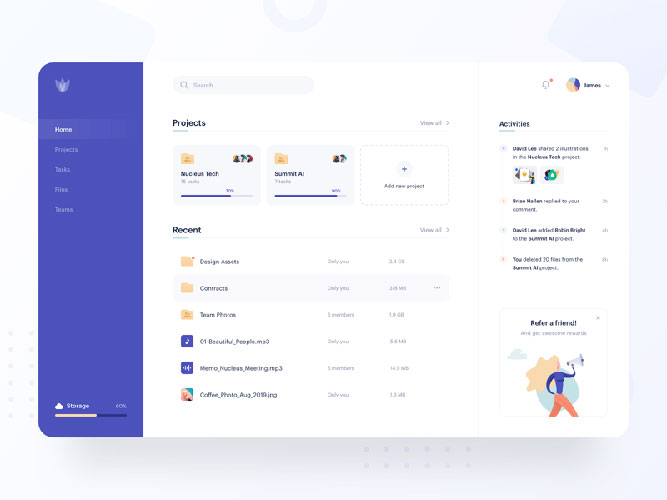

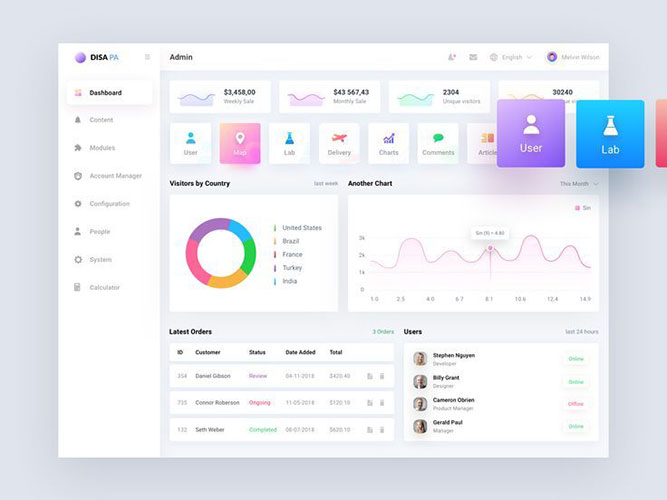

Our core area of services include: Cyber Security Risk Management; Information Theft and Fraud Prevention; Data warehouse design and construction; Data management; customer analytic; custom application development;business performance measurement;Business requirement analysis